Back in mid January the California Apparel News carried an article titled, "Full Steam  Ahead for 2015 as Economy Accelerates and Gas Prices Drop". It is reproduced below.

Ahead for 2015 as Economy Accelerates and Gas Prices Drop". It is reproduced below.

Ahead for 2015 as Economy Accelerates and Gas Prices Drop". It is reproduced below.

Ahead for 2015 as Economy Accelerates and Gas Prices Drop". It is reproduced below.

The first two paragraphs of the article state:

Just about everyone agrees that 2015 is shaping up to be a good year for the U.S. economy.

“We believe that 2015, barring any unexpected event, should be the best year since the beginning of the recession in 2008,” said Esmael Adibi, director for the A. Gary Anderson Center for Economic Research at Chapman University in Orange, Calif.

I had the pleasure of seeing Mr Adibi speak at a financial planning conference in Newport Beach in early 2008. The economy was faltering. The sub-prime foreclosures were becoming a serious issue. House prices were beginning their slide. All the indicators were pointing to a serious downturn.

Much to the angst of many at the conference who thought (or hoped, more like) that the housing price drop and the mounting foreclosure were just a short-term necessary correction of a obviously overheated real estate market, Mr Adibi predicted that real estate in Orange County would lose another 20% of its value. There was a stunned silence. After the presentation, there was a self soothing mix of disbelief about the prediction and bravado for the future among the attendees that I spoke to and heard in conversation.

I believed every word. Mr Adibi, who was then on Schwarzenegger's Council of Economic Advisors, was impressive. Cool and dispassionate with an well articulated synthesis of the facts and trends, Mr Adibi ended up being proved right and wrong. Yes, there was another 20% to come off the real estate prices but there was going to be a whole lot more.

Mr Adibi knows what he is talking about. So, let's look at his quote again: We believe that 2015, barring any unexpected event, should be the best year since the beginning of the recession in 2008.

"... the best year ..." Not a good year. And, by the way, not everyone believes that 2015 is going to be a good year. I don't. And I know quite few smart people in and out of the financial industry that are with me.

The New York Times on January 17 quoted Ian Shepherdson, chief economist at Pantheon Macroeconomics as stating that the overall economic benefits of the collapse in oil prices are significant. He predicted that it could add almost one percentage point to real GDP growth in the United States this year. In an economy trending at 2.25 percent annual growth, that’s a sizable gain.

That's great. Typically when the economy is healthy, GDP is growing which leads to low unemployment and wage increases as businesses demand labor to meet the growing economy.

Investopedia tells us that the general consensus is that 2.5-3.5% per year growth in real GDP is the range of best overall benefit; enough to provide for corporate profit and jobs growth yet moderate enough to not incite undue inflationary concerns.

USA Today reported on January 4:

The stronger U.S. economy and increased employer confidence should continue to bolster job gains, and economists expect sluggish wage growth to finally accelerate, though they're divided on how quickly that will happen.

Employers added 321,000 jobs in November, the most in nearly two years, and 2014 is on track to be the strongest for job growth since 1999. Economists expect a Labor Department report Friday to show that 230,000 jobs were added in December, according to median estimates, slightly below the 241,000 average for the first 11 months of the year.

So why am I am not on the "Party like its 1999" bandwagon? The headlines in the financial press are screaming that the economy is charging ahead. Am I just being a wet blanket?

I don't think I am, for these 3 reasons:

- I am not seeing all this optimism reflected on the street at the retail level.

- If we are back to pre-Great Recession employment levels, it doesn't feel like it.

- And I have a sneaking suspicion that we are in for a stock market correction.

Retail

Out there in the real world, the retailers that I am speaking with on a regular basis are not doing well. They are not experiencing the significant bump in business that you would expect from an economic upturn and an optimistic buying public. The holiday season was just OK and January was slow.

Out there in the real world, the retailers that I am speaking with on a regular basis are not doing well. They are not experiencing the significant bump in business that you would expect from an economic upturn and an optimistic buying public. The holiday season was just OK and January was slow.

When retail sales for the 2014 holiday season fell short of forecasts, many industry watchers declared the crucial shopping season a disappointment.

The Federal Reserve noted that: General merchandise retailers indicate that sales were generally sluggish and below plan for the holiday season overall. However, most retail contacts noted that, while November and early December were sluggish, sales did pick up toward the latter part of the month, especially in the week after Christmas. When everything was on sale, the Fed neglected to mention.

Just last week, Reuters reported that U.S. consumer spending recorded its biggest decline since late 2009 in December 2014 with households saving the extra cash from cheaper gasoline.

But on December 23, Bloomberg reported:

The American consumer is back, recharging the U.S. economic expansion.

The American consumer is back, recharging the U.S. economic expansion.

Households splurged on new cars, appliances, televisions and clothing as spending climbed 0.6 percent in November, beating the median forecast of economists surveyed by Bloomberg, according to figures from the Commerce Department issued today in Washington. The economy grew at the fastest pace in 11 years, another report showed.

So which is it? From what I am hearing, it is the former.

The nine-month labor dispute at the Ports of Long Angeles and Long Beach that is now threatening to shutdown the already log-jammed ports is having an impact on retail and the economy in general but there seems to be some disagreement in the financial press as to what the effect has been so far.

USA Today notes:

A full-blown port shutdown could cost the U.S. economy some $2 billion a day, the National Retail Federation has warned. Unlike some past labor disputes involving the ports, the latest escalation at least comes at a time when the holiday season has passed and many retailers aren't as in dire need of shipments of merchandise.

A full-blown port shutdown could cost the U.S. economy some $2 billion a day, the National Retail Federation has warned. Unlike some past labor disputes involving the ports, the latest escalation at least comes at a time when the holiday season has passed and many retailers aren't as in dire need of shipments of merchandise.

CNBC reports:

According to a Kurt Salmon analysis, congestion at West Coast ports could cost retailers as much as $7 billion this year. That congestion cost comes from a combination of the higher price of carrying goods and missed sales due to below optimal inventory levels.

According to a Kurt Salmon analysis, congestion at West Coast ports could cost retailers as much as $7 billion this year. That congestion cost comes from a combination of the higher price of carrying goods and missed sales due to below optimal inventory levels.

As of now, smaller retailers have been able to manage the shipping delays and inventory levels with suppliers eating increased shipping costs due to rerouting and air freight. The vertical integrated supplies must be feeling the cost and inventory pinch. The independent retailer has the benefit of the importer bearing the increased costs of getting goods to market. The longer the dispute goes on, the deeper the effect on the economy has to be.

Some reports indicate that even if negotiations lead to a quick resolution from here, normal operations are still months away because of the backlog so far. It may even take the bulk of 2015 for shipments to normalize.

Jobs

The recent unemployment figures show an unemployment rate of 5.6%. Supposedly, we are back to pre-Great Recession employment levels? Really? What are these jobs? Are they full-time? What about wages growth for those who are employed? I am very skeptical about the unemployment number. Many unemployed and underemployed are not counted. Without decent paying jobs, there is no disposable income. Without disposable income, there is no significant spending.

The recent unemployment figures show an unemployment rate of 5.6%. Supposedly, we are back to pre-Great Recession employment levels? Really? What are these jobs? Are they full-time? What about wages growth for those who are employed? I am very skeptical about the unemployment number. Many unemployed and underemployed are not counted. Without decent paying jobs, there is no disposable income. Without disposable income, there is no significant spending.

The Bureau of Labor Statistics reported the Labor Force Participation Rate at 62.9% for January 2015. That's the lowest it has been since 1978. Why is it so low?

Business Insider explains:

On the one hand, America is aging, and the baby boomers are beginning to retire. That leads to a natural demographic decline in the participation rate.

On the one hand, America is aging, and the baby boomers are beginning to retire. That leads to a natural demographic decline in the participation rate.

On the other hand, the US is coming out of the worst recession it has faced in decades, and the participation rate dropped much more sharply since 2008.

But just last week Bloomberg also reported:

U.S. employers added 257,000 jobs in January, capping off the best three months of consecutive employment growth in 17 years. December’s job gains were revised up to 329,000 and November to a whopping 423,000. According to the Bureau of Labor Statistics report Friday, the unemployment rate rose to 5.7 percent as more people started looking for work again. Best of all, average hourly earnings went up by 0.5 percent in one month, the most since November 2008.

U.S. employers added 257,000 jobs in January, capping off the best three months of consecutive employment growth in 17 years. December’s job gains were revised up to 329,000 and November to a whopping 423,000. According to the Bureau of Labor Statistics report Friday, the unemployment rate rose to 5.7 percent as more people started looking for work again. Best of all, average hourly earnings went up by 0.5 percent in one month, the most since November 2008.

The Stock Market

The stock market has been rising steadily since it bottomed out in March 2009. That is a long time. Many believe the market is overvalued and due for a correction. A correction is defined as a reverse movement, usually negative, of at least 10% in a stock, bond, commodity or index to adjust for an overvaluation.

The stock market has been rising steadily since it bottomed out in March 2009. That is a long time. Many believe the market is overvalued and due for a correction. A correction is defined as a reverse movement, usually negative, of at least 10% in a stock, bond, commodity or index to adjust for an overvaluation.

In late January, CNN Money reported that: The bears build their case that a crisis is near on four factors: falling oil prices, stagnant wages, the "two-edged sword" of a strong US dollar and big trouble abroad.

The strong dollar makes US exports more expensive and less attractive to foreign buyers.

While Microsoft, Procter & Gamble and United Technologies reported solid earnings in January, their shares dropped as much as 10% because of forecasts of weaker sales abroad due to the strong U.S. dollar. These companies employ thousands.

Due to the lower oil prices, energy companies and related sectors are laying off thousands. The lower gas prices are helping the economy on one hand but hurting on another.

Global Economy

The global economy is sagging. Just yesterday, NPR reported:

The global economy is sagging. Just yesterday, NPR reported:

There's good reason to be concerned, says Jeffrey Snider, head of global investment research at Alhambra Partners.

"Whenever you see oil prices collapse, especially by something like 60 percent, something else is going on, and so therefore, any benefit that might come to consumers in the form of lower energy prices is being overwhelmed by whatever it is that's causing oil to fall in the first place," Snider says.

And falling oil prices are a clear sign of a dangerously weak global economy, he says.

"You have economies from Europe, Japan, China that are either in or very close to recession or some form of growth that is significantly degraded," Snider says.

And, he says, recent data suggest U.S. consumers are saving most of their windfall from lower energy prices, not spending it to fuel growth.

"That's an indication of very cautious behavior," he says.

That caution suggests underlying problems in the U.S. economy, including slow wage growth, he says.

From CNN Money:

The question is whether American consumers and businesses will spend enough to offset the global slowdown. But so far, wages have been flat for many Americans during the recovery.

The question is whether American consumers and businesses will spend enough to offset the global slowdown. But so far, wages have been flat for many Americans during the recovery.

Adjusting for inflation, median weekly wages were $790 in the fourth quarter of 2007; they barely budged up 1% to $796 the last quarter of 2014.

And the CNN Money article concludes with:

Weaving their four factors together, the bears' quilt for 2015 is quickly looking gloomy and gray. The U.S. markets are already overdue for a correction -- a drop of 10% or more -- and this global backdrop could exacerbate the fall when it comes.

Weaving their four factors together, the bears' quilt for 2015 is quickly looking gloomy and gray. The U.S. markets are already overdue for a correction -- a drop of 10% or more -- and this global backdrop could exacerbate the fall when it comes.

I hope that the Bears and I are completely wrong.

So you can see that not everyone is convinced that 2015 is shaping up as a good year for the US economy.

I want the economy to improve as much as anyone else. We have had 6 long years of cold and painful recovery from the deliberate superheating and crashing of the economy by the Bush Administration. While the private sector hasn't completely rebuilt the economy in their own likeness as planned, big business has done very nicely thank you very much after being bailed out by public money, and in place to reap the rewards of the publicly subsidized recovery. It is time for us, the public who rescued the economy from near collapse, to enjoy some economic sunshine.

I'll be happy with the best year since the Great Recession.

Paul Brindley

paul brindley consults

paul brindley consults

California Apparel News

FINANCE

Full Steam Ahead for 2015 as Economy Accelerates and Gas Prices Drop

Just about everyone agrees that 2015 is shaping up to be a good year for the U.S. economy.

“We believe that 2015, barring any unexpected event, should be the best year since the beginning of the recession in 2008,” said Esmael Adibi, director for the A. Gary Anderson Center for Economic Research at Chapman University in Orange, Calif.

But how that translates into apparel and textile makers is another thing.

Even though the economy was on solid footing last year with the nation’s gross domestic product rising an estimated 2.3 percent, several clothing manufacturers and retailers saw overwhelming challenges to their business.

A shift in the way clothes are sold and by whom continues to transform the industry, creating winners and losers. Particularly affected are brands and retailers that cater to the juniors market. They have seen the floor pulled out from under them as teens flock to the lowest-priced seller.

“Children’s and teens’ apparel did well last year, but the teen stores didn’t,” said Britt Beemer, a retail analyst and founder of America’s Research Group, which polls 1,200 consumers a week to take the pulse of their retail-spending attitude. “Wal-mart and Target got 9 percent more teen shoppers than one year ago.”

Juniors retailers such as Forever 21 and H&M have been expanding their stores. They offer merchandise at rock-bottom prices and churn out new styles faster than you can sew on two new buttons.

“For us it has been a good year, but it is tumultuous,” said Ike Zekaria, vice president and co-owner of Los Angeles–based teen retailer Windsor Fashions Inc. “A lot of our competitors are going out of business.”

Those competitors are Delia’s, a New York–based juniors apparel retailer that announced at the end of last year it was filing for Chapter 11 bankruptcy protection and closing its 95 stores after being in business for 22 years.

The Wet Seal, a Southern California juniorswear store chain that has been on and off the financial ropes, said in January it would shutter 338 stores and lay off 3,650 employees. The chain still has 173 stores, based mostly in malls. Many speculate that the teen retailer will be headed for bankruptcy court soon if a buyer for the retailer isn’t found soon.

To add to pricing challenges, apparel makers are seeing mid-tier retailers scooping up brand-name licenses or the names themselves and selling them exclusively at their stores. Traditional independent brand names that have been a staple in the stores are being booted out the door.

One Los Angeles company executive, who didn’t want his name or company mentioned, said that for years he supplied Kohl’s. But the Wisconsin-based retailer started stocking the Vera Wang, Rock & Republic and Jennifer Lopez brands. Three years ago he was cut out of the loop, costing him $24 million in sales.

Many apparel makers were working every angle to market their labels. Chaudry, a Los Angeles label started in 1976 by Krishan Chaudry, has seen its revenues increase 30 percent in the last year, but the company has taken to the social-media airwaves to get the word out about the line, known for its brightly colored bohemian prints and crochet details. It caters to the 30- to 55-year-old woman. “We are doing everything possible to reach the influencers and bloggers,” said Ravi Bhushan, the company’s sales director. “We are doing all the trade shows.”

Recently, the brand added a new label called Chaudry Black, a line of hand-beaded dresses and tops selling at Anthropologie and Free People. Wholesale prices range from $99 to $169.

“It is challenging out there. You have to be innovative,” Chaudry said. “If you have things that are different, it is very good.”

Gas it up

This year, retailers and apparel makers have given the gift that keeps on giving. Gas prices have plummeted, now at a national six-year low. Who would have thought that the average price of gas across the nation would nosedive 35 percent in a year, dipping from $3.23 a gallon to around $2.11 a gallon. Gas prices are slightly higher in California.

That means instead of spending $58 to fill up a mid-size car, it now costs $38. Gas prices are expected to remain low through 2016. “Whenever gas prices go down, it is like a tax cut for consumers,” Adibi said. “That extra money does two things. It reduces people’s debt or increases their savings. Or it can be spent. In all likelihood, a good portion of it is going to be spent.”

The downside is for oil-producing states and countries now seeing their oil revenues drop. In the United States, Texas is the country’s No. 1 oil producer, followed by North Dakota and then California. So there could be some layoffs in the state’s petroleum industry and declines in revenue for businesses and services that supply them.

It’s off to work we go

Job creation in California has been more robust than in the rest of the country, offsetting the large number of jobs lost during the recession that started in 2008.

California’s unemployment rate in November was 7.2 percent compared with 8.4 percent during the same month in 2013. The state’s unemployment rate peaked in February 2010 at 12.4 percent.

But Los Angeles County is still behind in tackling its unemployment rate, which stands at 7.9 percent. That should change by mid-2015. “Los Angeles still has not recovered all the jobs it lost during the recession,” said Robert Kleinhenz, chief economist at the Los Angeles County Economic Development Corp. “We are still very reliant on government jobs and jobs tied to the defense industry. Government jobs have been slow to come back. But by mid-2015, Los Angeles County should recover all the jobs it lost during the recession.”

Los Angeles County’s unemployment rate peaked at 13.3 percent in July 2010.

“Industries where gains have been more pronounced have been in healthcare, professional services and business services,” Kleinhenz said. “Leisure and hospitality have been adding jobs over the past couple of years due to the growth in the tourism component of the local economy.”

Jobs associated with the Port of Los Angeles and the Port of Long Beach should also be on the upswing because international trade is expected to rise, even though the ports have been plagued with congestion problems.

“Import volumes on the West Coast, despite all the problems there, were the highest since 2009,” said Ben Hackett, founder of Hackett Associates, which tracks national port traffic for the National Retail Federation.

For the first 11 months of 2014, cargo volumes at the Port of Los Angeles were up 6.5 percent over the previous year while at the Port of Long Beach they rose 1.7 percent.

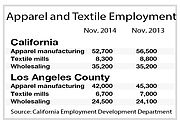

Jobs in California’s apparel manufacturing sector continued to slide, dipping 4.1 percent in November compared with the previous year. Nationally, they declined 6.4 percent.

No comments:

Post a Comment